The cup and handle pattern is one of the most reliable bullish chart patterns in technical analysis. Popularized by legendary investor William O'Neil in his book How to Make Money in Stocks, it shows a period of consolidation followed by a breakout, often signaling the start of a strong upward trend.

Whether you are trading stocks, forex, or crypto, understanding this pattern can dramatically improve your timing and accuracy. This guide explains everything clearly: how the pattern works, how to trade it, profit targets, common mistakes, and real-world examples.

What Is a Cup and Handle Pattern?

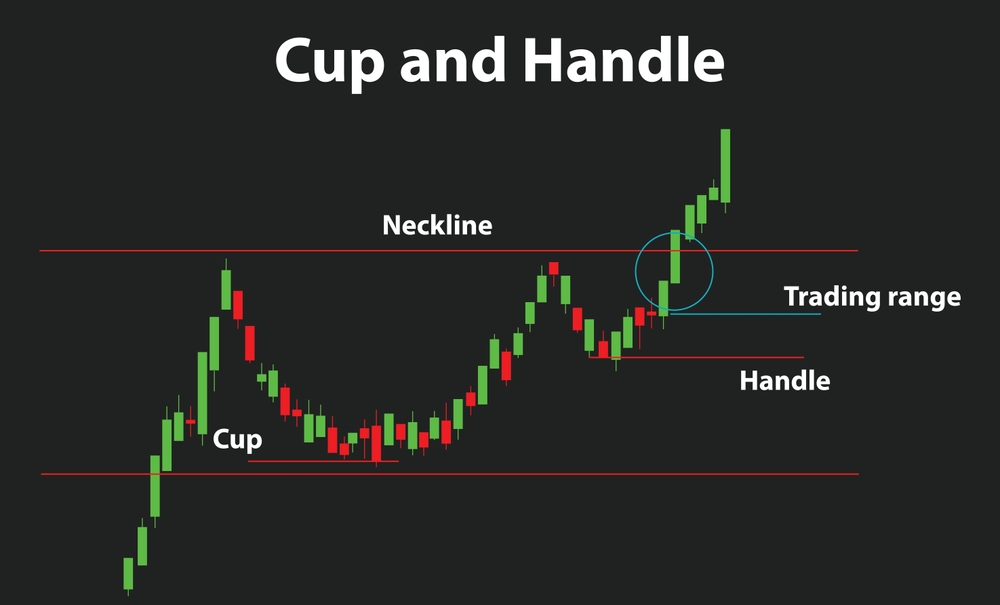

The cup and handle pattern is a bullish continuation pattern that resembles the shape of a teacup. It has a rounded bottom (cup) followed by a small pullback (handle) on the charts. It is a tool to spot breakout configurations that signify the continuation of a trend.

The Cup and Handle pattern shows that after a price drop, the asset is being rebought, followed by a small, healthy dip (retracement) before the price moves higher. The final breakout happens when buyers take full control from sellers.

This pattern is observed in various markets, including stocks, Forex, cryptocurrency, indices, and commodities, and it is most effective when the asset is already in a clear upward trend.

How the Cup and Handle Pattern Works

To understand why the pattern is so powerful, you must understand the psychology behind it:

The Cup Phase: The "Cup" part of the pattern is shaped like a 'U' or a bowl on a price chart. It forms when the price first drops gradually, then finds a rounded bottom (not a sharp V-shape), and finally rises back up. This shows the market is taking a break or consolidating after a previous upward trend. During this time, sellers lose interest, and buyers slowly step in, absorbing the available supply, which shifts the market feeling from negative to neutral and finally positive.

The Handle Phase: After the price reaches its previous high, it usually struggles to move higher right away, which creates the "handle." This handle is a small drop in price, forming a short downward channel with weak selling and some traders taking quick profits. Essentially, the handle is a final stage where weak investors are shaken out. It looks like a smaller 'U' shape, with the price dropping between 10% and 50% of the cup's height on low volume before rising back to the resistance level, indicating that there isn't much pressure to sell before the price potentially breaks out.

The Breakout: At this point, the buying momentum increases, fresh buyers enter the market, and the upward trend strongly continues. This price breakout, confirmed by rising bullish volume penetrating the pattern's resistance area, is the signal that triggers the buying momentum and provides entry points for traders.

The Resistance: The resistance trendline is a straight line, either flat or sloping down, that connects all the highest price points (swing highs) along the top of the "cup and handle" pattern. This line marks the pattern's top edge.

How to Identify a Valid Cup and Handle Pattern

To reliably identify a valid Cup and Handle pattern and avoid false signals, adhere to the following rules:

Prior Uptrend: The pattern must follow an established uptrend, as it functions as a continuation, not a reversal, pattern.

Cup Shape: The cup should have a rounded, 'U' shape, indicating proper consolidation. A 'V' shape is less reliable due to the lack of sufficient consolidation.

Handle Direction: The handle should ideally slope downward. A sideways drift can also be acceptable, but a clear downward slope offers greater validity.

Volume Analysis: Volume should typically decrease as the cup forms. Healthy accumulation is characterized by low volume at the bottom of the cup and high volume during the breakout.

Handle Depth: The handle should not drop excessively deep. An ideal maximum depth is one-third (1/3) of the cup's depth.

A cup and handle pattern is invalid if any of the following occur:

- The cup forms without a preceding uptrend.

- The cup is too shallow, suggesting weak accumulation.

- The cup is too deep, which may indicate a weak underlying trend.

- The handle drops more than 50% of the cup's total height.

- The breakout occurs without a corresponding increase in volume.

Related Read: Candlestick Day Trading Patterns: How to Read and Trade Like a Pro

How to Trade the Cup and Handle Pattern (Step-by-Step)

Here is a clear, practical method used by traders in the cup and handle pattern:

Identify the Cup

The first step is to identify the cup, and you do this by confirming that the cup bottom is rounded with a reasonable depth. Avoid V-shaped cups, as they are unreliable. Also, check that the Price returns to the previous high. You can identify this by manually browsing finance charts or by using a pattern scanner.

Wait for the Handle

This smaller pullback is essential for reliability. Traders are advised to wait for the Handle to fully develop and confirm its structure before initiating a trade, as prematurely entering based only on the Cup formation significantly increases risk and reduces the statistical reliability of the entire pattern.

Set an Entry at the Breakout Level

The optimal entry point for a cup and handle pattern is the breakout point, which occurs when the price penetrates the trendline resistance level of the pattern. At this long entry point, traders should look for an increase in buying volume and strong bullish momentum as the price moves above the neckline resistance. To avoid entering the trade too early, place a buy stop order slightly above the handle's upper resistance line.

Place a Stop-Loss

Two safe options for setting a stop-loss are: the standard approach, which is below the handle low, or the more conservative approach, which is below the midpoint of the cup.

Calculate Your Profit Target

The profit target for this technical analysis pattern is calculated using a straightforward formula:

Profit Target = Cup Depth + Breakout Price

Example Calculation:

If the Cup Depth is $10

And the Breakout Price is $50

The resulting Target is $60

This is a standard and commonly employed measurement technique in technical analysis.

Risk Management of a Cup and Handle Pattern

When trading the Cup and Handle pattern, you manage risk by setting a stop-loss order just below the lowest point of the handle part of the pattern. A common rule is to risk only 1% of your total trading money on any single trade, and you adjust how many shares or contracts you buy to make sure your potential loss fits this 1% limit.

Risk management is vital because it helps protect your money from big losses, especially if the pattern fails, gives a false signal, or the price drops unexpectedly after what looked like a successful breakout.

The risks involved in trading this pattern include sudden price drops overnight (gap downs), issues in markets where it's hard to quickly buy or sell (illiquidity), not getting the exact price you wanted for your order (slippage), and unexpected major news that can increase your losses. Despite these risks, the Cup and Handle pattern typically offers a good reward-to-risk ratio, often 2.50 to 1, meaning you aim to make $2.50 or more for every $1 you risk.

Pros and Cons of the Cup and Handle Pattern

Pros

- Highly reliable as a continuation pattern.

- Applicable across various markets.

- Its well-defined structure makes it easy for beginners to understand.

- Often leads to significant breakout moves.

Cons

- Requires a high degree of patience.

- The 'handle' portion can sometimes form incorrectly, leading to invalid signals.

- Beginners are susceptible to 'fake breakouts.'

- The pattern's validity depends on confirmation from trading volume.

Common Mistakes Traders Make

To prevent premature exits or unsuccessful trades, be sure to avoid these frequent mistakes:

- Premature Entry: Entering the trade before the confirmed breakout occurs.

- Trading a V-Shaped Cup: Buying when the "cup" formation is sharply V-shaped instead of a smoother, U-shaped bottom.

- Downtrend Trading: Attempting to trade the pattern while the overall market trend is bearish (a downtrend).

- Ignoring Volume Confirmation: Failing to check for the necessary increase in trading volume during the breakout.

- Using Overly Tight Stop-Losses: Setting stop-losses too close to the entry point can lead to being stopped out by normal market fluctuations.

- Miscalculating Handle Depth: Misjudging the size or depth of the handle formation, which should not drop into the bottom half of the cup.

Final Thoughts

The cup and handle pattern is a powerful chart pattern used by both beginner and professional traders. When identified and traded correctly, with volume confirmation, proper entry, and realistic profit targets, it can provide high-probability setups in stocks, forex, and cryptocurrency markets.

Read More: Is Day Trading Illegal? Laws, Rules & Regulations Guiding Day Trading In 2026

Sources

- Investopedia: Master the Cup and Handle Pattern: Trading Strategies & Targets

- Bapital: Cup and Handle Pattern: Shape, How to Trade with Examples

Frequently Asked Questions

Is the cup and handle pattern reliable?

Yes. Research by William O'Neil found that it has one of the highest continuation success rates among chart patterns.

What timeframe works best?

The Cup and Handle pattern yields the strongest, most reliable signals on daily and weekly charts. Daily charts offer a good balance for significant, sustained moves. Weekly charts produce the strongest and most dependable signals, indicating major, long-lasting trends. Lower timeframes (e.g., hourly) are less reliable due to market "noise." For the highest probability of success and strongest potential price moves, traders should prioritize Daily and weekly charts.

How often does the cup and handle pattern fail?

The Cup and Handle pattern is considered to have failed when there is weak trading volume, the handle formation is excessively deep, or if the overall pattern develops within the context of a prevailing downtrend.

Can beginners trade this pattern?

Yes. It's one of the easiest patterns for beginners to recognize.

Does the pattern work in crypto?

Yes, but crypto's volatility means more fake breakouts. Traders have to be more cautious with it.

Is the cup and handle bullish or bearish?

Bullish. The inverted version is bearish.

Follow Us On Social Media