If you want to make consistent profits on your trades, it is no brainer that you need an effective strategy. The Gap and Go strategy is one that consistently stands out for helping traders with setups that make them profits.

Every trading day, stocks open significantly higher or lower than their previous closing price. Sometimes these gaps fade quickly. Other times, they trigger strong momentum that continues throughout the session. The Gap and Go strategy focuses on identifying stocks that gap strongly and continue moving in the same direction after the market opens. When executed correctly, Gap and Go trades can deliver profitable returns. However, they require preparation, discipline, and strict risk management.

This guide breaks down how to spot, trade, and refine it effectively for repeatable results, drawing from proven trader playbooks.

What is the Gap and Go Strategy?

The Gap and Go strategy is a momentum-based day trading technique that focuses on stocks that open significantly above their previous day's closing price and continue rising after the market opens. Here, traders target stocks that "gap up" significantly from the previous close to the open, often 3-10% or more, fueled by catalysts like earnings beats or news. Traders enter long positions in the first 15-30 minutes to ride the explosive early momentum before it fades.

You can identify stocks that gap up by analyzing pre-market and post-market trading activity, and utilize technical indicators like moving averages to confirm. Then enter the trade when the stock breaks above the opening price and shows continued upward momentum.

These gaps usually occur because of:

- Earnings reports

- Breaking news or corporate announcements

- Analyst upgrades or downgrades

- FDA approvals or regulatory news

- Institutional buying or market sentiment shifts

The strategy aims to catch early momentum while volume and volatility are highest, usually during the first hours of the trading session.

How to Find and Trade Gap and Go Stocks

Successful Gap and Go trading starts before the market opens. The goal is to identify stocks that are gapping higher due to strong catalysts and showing enough volume and momentum to continue trending after the open.

Professional traders rely on a structured premarket routine to identify high-probability opportunities rather than reacting emotionally once the market becomes volatile. Here is a step-by-step setup for finding gap and go trades.

1. Scan the Premarket (4:00 AM – 9:30 AM EST)

The process begins with scanning the premarket session between 4:00 AM and 9:30 AM EST. Traders look for stocks showing strong momentum, typically those gapping 3–5% or more with at least twice their average trading volume. Many traders also focus on stocks with market capitalizations above $100 million to ensure adequate liquidity.

Equally important is identifying a clear catalyst, such as earnings releases, FDA approvals, contract announcements, or major news events. These catalysts often provide the fuel that drives continued price movement during regular market hours.

After identifying potential candidates, traders analyze premarket volume and price structure to confirm genuine market interest. The final step of premarket preparation is building a focused watchlist of approximately 3–8 high-quality setups, which helps traders stay organized once the market opens. High premarket volume is especially important because it signals strong participation and improves trade liquidity.

2. Confirm Strength After Market Open

Not every gap results in continuation. Once the market opens, traders wait for confirmation that buyers remain in control before entering a trade.

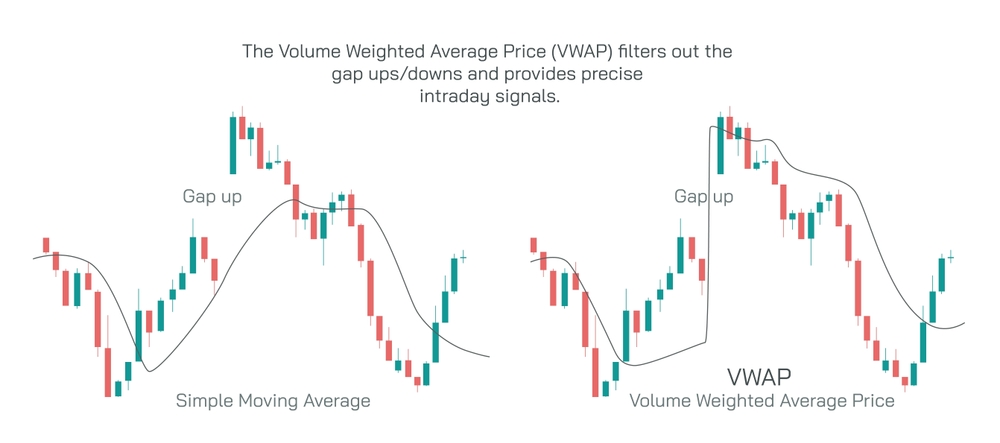

Strong Gap and Go stocks typically hold above key technical levels such as the opening price and VWAP (Volume Weighted Average Price). Traders also look for strong opening volume, price stability above premarket support levels, and the formation of higher highs and higher lows, which signal sustained bullish momentum.

Additionally, comparing the stock's performance to the broader market, such as the SPY index, helps confirm relative strength. If momentum fades quickly or volume declines sharply, many traders avoid entering the trade altogether.

3. Identify the Entry Trigger

Most Gap and Go entries occur within the first 5–15 minutes after the market opens. Traders typically wait for confirmation before entering and rely on several common entry strategies.

One popular method is the break of premarket high, where traders enter once the price breaks above premarket resistance levels with strong volume confirmation. Another widely used strategy is the first pullback entry, where traders wait for a brief consolidation or controlled dip before entering, often providing a better risk-to-reward ratio.

Some traders also use the opening range breakout, entering when the price breaks above the early trading range formed shortly after the market opens. Limit orders are often preferred to reduce slippage during fast-moving price action.

4. Set Profit Targets and Plan Exits

Gap and Go is a momentum-driven strategy, which means traders rarely exit positions all at once. Instead, many traders scale out of positions gradually.

A common approach is taking partial profits; often 25–50% of the position, once the stock moves 2–3% in their favor. The remaining position is then managed using trailing stops, allowing traders to capture extended moves that can reach 5–10% or more, depending on market strength.

Momentum trades require strict exit discipline. If a stock fails to continue trending shortly after the open, many traders close positions by 10:00 AM to 10:30 AM EST. Other common exit signals include price dropping below the opening low, signs of a gap fill, declining volume, or slowing momentum. Consistent traders focus on locking in profits rather than trying to capture the entire price move.

5. Apply Risk Management Rules

Risk management is one of the most important factors in long-term trading success. Professional Gap and Go traders typically follow strict rules to protect their trading capital.

Most traders risk only 1–2% of their total account balance per trade and place stop losses below pullback support levels or VWAP. They also avoid chasing extended or overbought candles, which often lead to poor entry points.

Many traders set daily maximum loss limits to prevent emotional trading and reduce position sizes during low-volume setups where price movements can become unpredictable. Strong risk discipline helps traders survive losing streaks and maintain consistent performance over time.

Read More: How to Trade Momentum Stocks: Strategies, Indicators & Risk Management

Recommended Premarket Scanner Settings

Traders rely heavily on stock scanners to identify potential Gap and Go opportunities. The following settings are widely used:

- Gap Percentage: 5% – 20%

- Premarket Volume: 100,000+ shares

- Price Range: $2 – $50 (momentum range)

- Relative Volume: 2x or higher

- Float Size: Low to medium float

Premarket scanning allows traders to build a focused watchlist and prepare trading plans before market volatility increases. You can use Scanz, TradingView, or Thinkorswim as a platform for premarket scanning.

Read More: Best Stock Scanners for Day Trading & How to Use Them

Example Trade Execution

Take for example, if ABC stocks have a premarket gap of +8% after a strong earnings report with a premarket volume of 600,000 shares (3x average). At the market open, price holds above the premarket high, with VWAP support intact.

The trade execution will go like this:

- Entry: $50.50 (break of premarket high)

- Stop-loss: $49.80 (below VWAP support)

- Partial exit: 50% at $52.00

- Trailing stop manages the remainder until $54.00

The result is that the trader will capture a 6–7% intraday move, consistent with typical Gap and Go setups.

Pros and Cons of the Gap and Go Strategy

Pros:

- Performs best in strong bullish market environments

- Highly effective during earnings seasons when catalysts are abundant

- Works well in high-news volatility periods with fresh headlines driving momentum

- Benefits from high-liquidity trading sessions, ensuring smoother entries and exits

- Momentum thrives when market sentiment supports aggressive buying

Cons:

- Can fail with weak or fake news catalysts that don't sustain momentum

- Struggles in low liquidity and low volume environments

- Vulnerable to overall market reversals, even if the stock gaps strongly

- Risk of losses from late entries after extended moves

- Requires discipline, successful traders must recognize failed momentum quickly and exit early

Conclusion

The Gap and Go strategy is a proven momentum trading method that allows day traders to capture fast intraday moves. By combining premarket scanning, strong catalysts, technical confirmation, disciplined entry/exit rules, and strict risk management, traders can turn it into a repeatable workflow.

Successful Gap and Go trading is not about chasing every gapping stock; it's about quality setups, patience, and execution. When approached systematically, it can become a reliable tool for consistent intraday profits.

Related Read: 15 Proven Day Trading Strategies For A Profitable Trade

Frequently Asked Questions

What percentage gap is best for Gap and Go trading?

Most traders look for gaps between 5% and 20%. Smaller gaps may lack momentum, while extremely large gaps can become overextended.

Is the Gap and Go strategy beginner-friendly?

Yes, but beginners should focus heavily on risk management and paper trading before risking real capital.

Do all gaps continue trending?

No. Many gaps reverse or fade. Confirmation through volume, price structure, and news catalysts improves success probability.

What timeframe works best for Gap and Go trades?

Most Gap and Go trades occur within the first one to two hours after the market opens, when volatility and liquidity are highest.

Can Gap and Go be used for short selling?

Yes. Traders can apply the same concept to gap-down stocks that continue trending downward.

Which markets support Gap and Go trading?

The strategy is most commonly used in U.S. equity markets because of strong liquidity and consistent premarket activity.

What's a realistic win rate with the Gap and Go strategy?

Experienced traders often achieve 55–65% with disciplined entries and exits.

Follow Us On Social Media